alameda county property tax history

Alameda County Tax Collector 1221 Oak Street Room 131 Oakland CA 94612 Phone. County of Los Angeles Treasurer and Tax Collector Secured Property Tax Division 2019A Public and 2019A Follow-Up Auction.

Alameda County Ca Property Records Search Propertyshark

The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900.

. Alameda County Property Records are real estate documents that contain information related to real property in Alameda County California. In addition it is the local government for all unincorporated areas and provides services such as law enforcement to some incorporated cities under a contract arrangement. Secured tax bills are payable online from 1062021 to 6302022.

Property Tax Installment Plans. We are accepting in-person online and mail-in property tax payments at this time. Most supplemental tax bills are payable online to 6302023.

Alameda County collects on average 068 of a propertys assessed fair market value as property tax. Quickly search property records from 19 official databases. Penalty Cancellation Due to a Lost Payment Affidavit.

The County is committed to the health and well-being of the public. LOS ANGELES COUNTY TAX COLLECTOR PO. Cook County collects on average 138 of a propertys assessed fair market value as property tax.

Review sales history. Property Tax Payment History. Alameda County ˌ æ l ə ˈ m iː d ə.

Top 5 DOs and DONTs. Excluding Los Angeles County holidays. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800.

BOX 54018 LOS ANGELES CA 90054-0018. The county was formed on March 25. Prior Year Delinquent tax payments are payable online to 6302023.

Effective October 1 2021 we are resuming limited in-person services at the Kenneth Hahn Hall of Administration Monday through Friday between 800 am. Looking for FREE property records deeds tax assessments in Santa Clara County CA. Property records tax collection and public health.

Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes. Search Secured Supplemental and Prior Year Delinquent Property Taxes. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

SECURED REAL PROPERTY TAX PENALTIES. Alameda County has one of the highest median property taxes in the United States and is ranked 68th of the 3143 counties in order of median property taxes.

Property Tax Data Alameda County Assessor

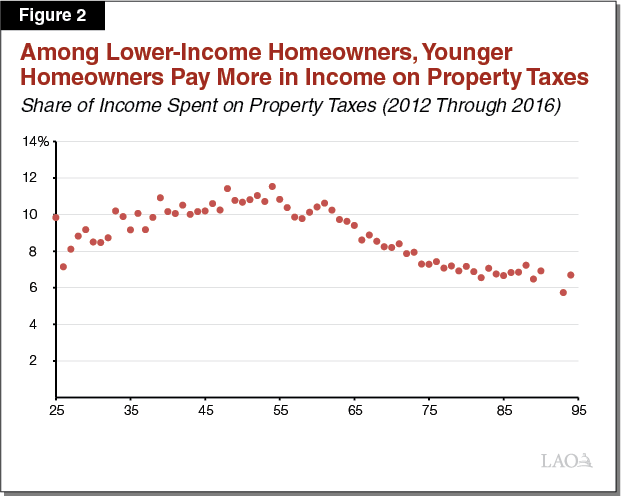

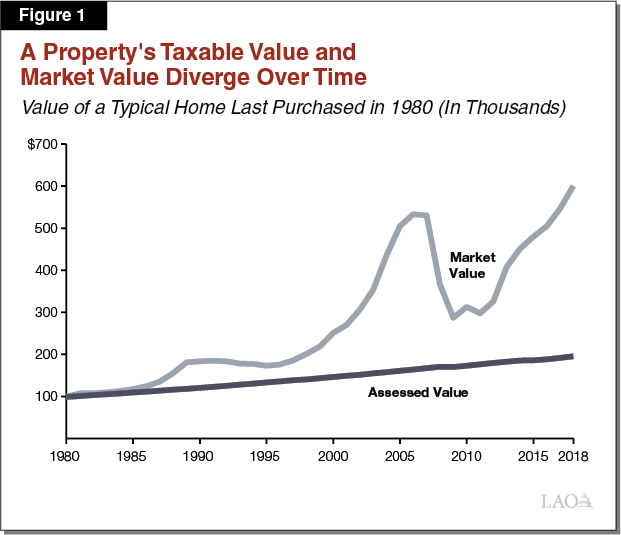

Evaluation Of The Property Tax Postponement Program

Evaluation Of The Property Tax Postponement Program

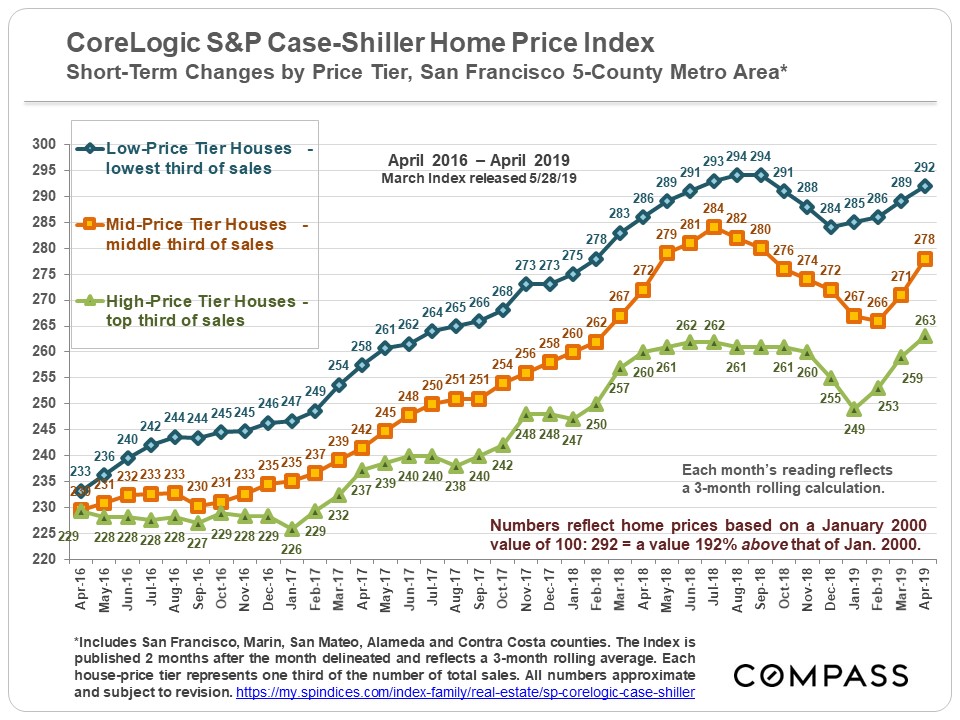

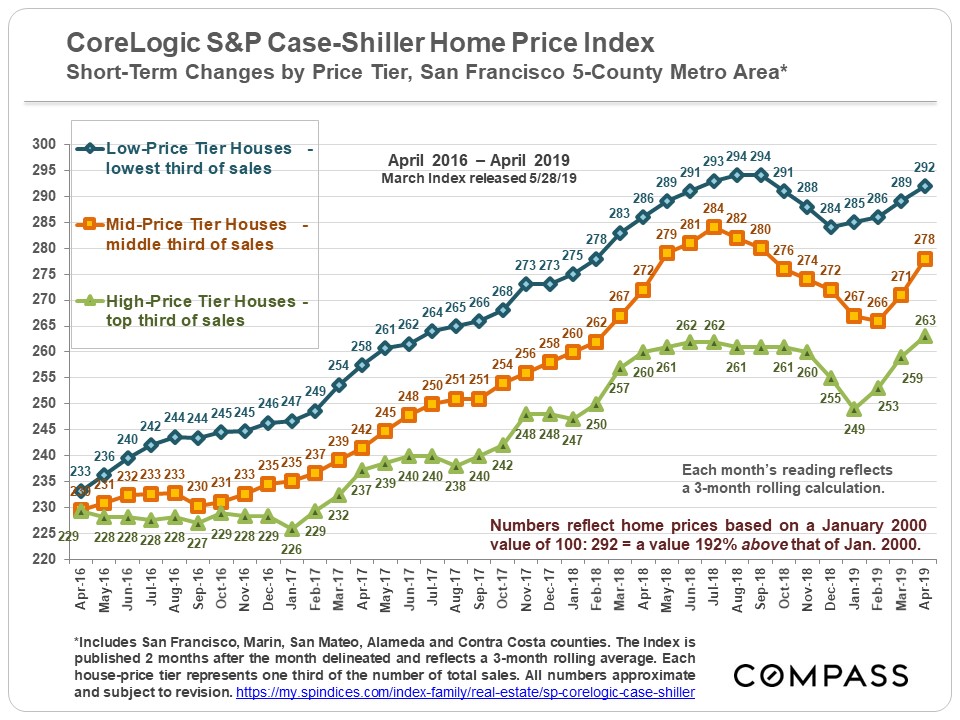

30 Years Of Bay Area Real Estate Cycles Compass Compass

Meet The Assessor Alameda County Assessor

Alameda County Ca Property Records Search Propertyshark

California Assessor And Property Tax Records Search Directory

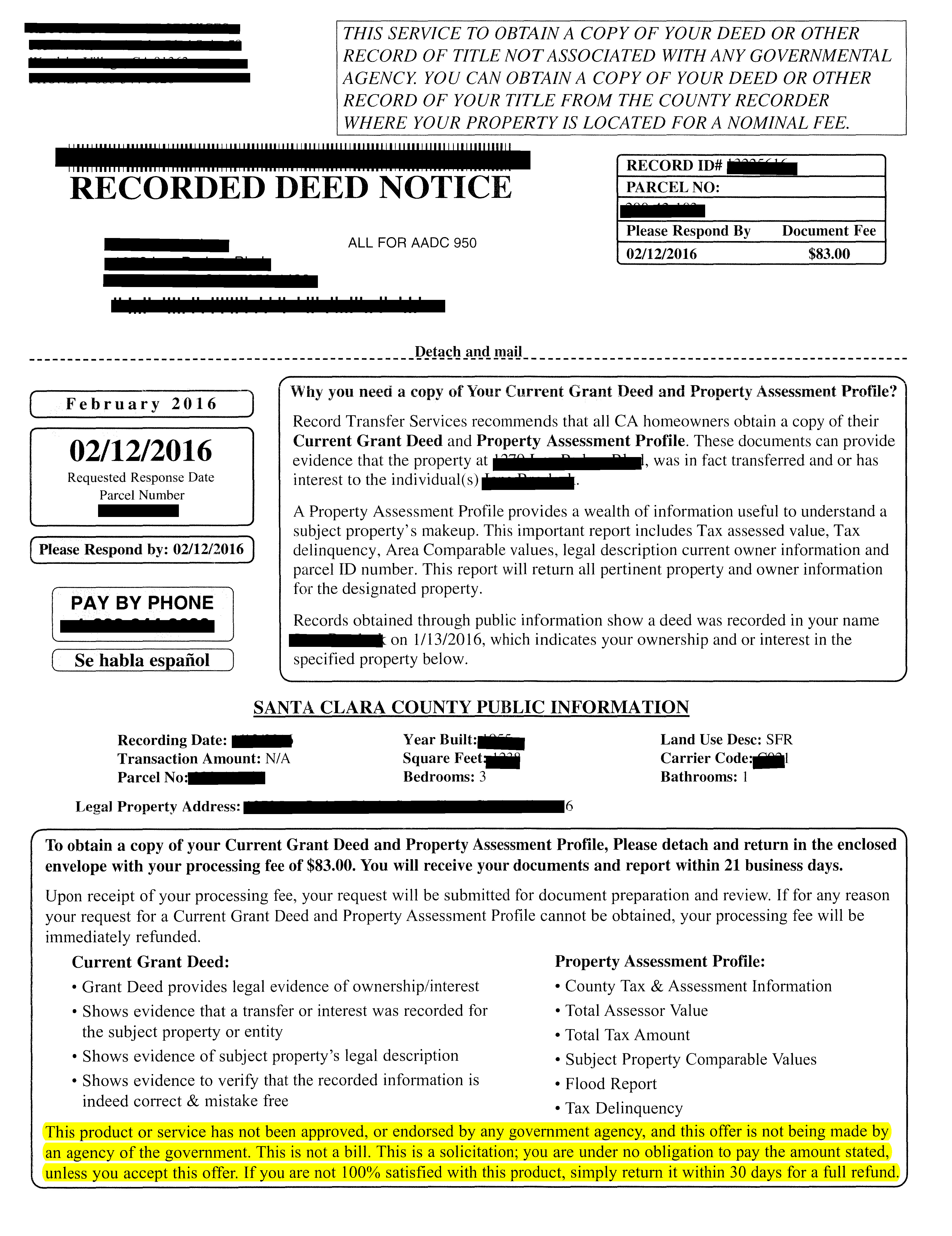

Have You Received A Recorded Deed Notice Mailer Litherland Kennedy Associates Apc Attorneys At Law

Alameda County Ca Property Records Search Propertyshark

How To Perform A Property Records Search In California We Lease San Diego